The life of a modern person is very dynamic. This is why saving your time is important. If you urgently need cash and there is no time on long paperwork and queues at banks, the Mobile Loan service with a quick solution is the most convenient option. Previously, this form of lending was rare.

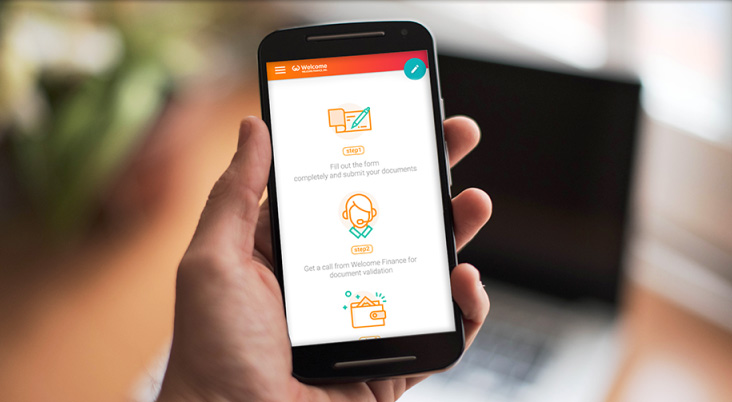

Making a loan through the application on the phone is one of the most popular ways to get money on credit. It is not surprising, because mobile devices are now firmly embedded in our reality. If you need an urgent loan and there is no time to wait until the bank approves the loan, then by downloading the application and sending an application, you will receive a loan to the card within 15 minutes. You only need a bank card and a passport. Without inquiries, collaterals and calls.

At first, this service was provided only by Payday lenders, but since 2012, banks also began to offer loans online. Gradually, this service has improved and today banks have their own app for Android and iOS. Why are the vast majority of online loan applications created for the iOS and Android OS? Because these are the most common operating systems used on smartphones since 2008.

Almost all companies issuing Mobile Loan have their own applications. This is very convenient, since the majority of the population today uses smartphones, rather than push-button mobile phones.

What are the main advantages of applying for a loan?

Loans through the application: pros and cons.

Consider the main advantages:

- Quick access.

- Save Internet traffic.

- Mobility: a phone or tablet is always at hand.

- Mobile applications remember data about the borrower.

- Convenient and intuitive interface.

- Round-the-clock acceptance of applications.

The main advantage of mobile credit is that you fill out the application at home, which allows you to bypass the queues at the application stage and do not spend on the way to the Bank or pawn shop and back.

To get money on credit, just download the application on your mobile phone. By downloading the app, you can apply for a loan online (including loans on the card and cash loans up to 30,000 pesos) without leaving home. You can fill out an application any day at your convenience. You will need to provide personal information. From the documents you need only a passport. Loan application takes about 5 minutes to complete. Most of the questions in the application are related to your data: age, education, the desired loan amount and goals of obtaining a loan. And to a greater extent the answer to it depends on the credit history of the borrower and the more honest the answers given, it is all the more likely that this statement will be approved.

After sending the application, you will have to wait for its approval. They review applications very quickly from 15 minutes to 1 hour. If approved, you will receive an SMS with information on your loan or a bank employee will contact you. If the bank refuses your application, then a repeated application to the same bank can be submitted in a few months (from 1 to 6 months). It is assumed that by then you will have either a higher monthly income, or you will ask for a smaller amount.

Some banks offer “turnkey” services. That is, you do not even have to contact the bank to sign the necessary documents. As a rule, the Manager will come to your home or office. There are also companies that transfer money to your card or bank account. If you chose to transfer to a card, then you must have a MasterCard, Visa bank card. Pre-register the card on the site – enter: your expiration date, card number, CVV code (indicated on the back of the card), name of owner. If it’s more convenient for you to get money to your current account, then enter information about your bank account. You may have several accounts, but it is imperative that these accounts belong to you personally. Money will be sent to your active bank account. As soon as the application is approved, the money will be credited to your account.

And now let’s focus on the shortcomings:

- High interest

- Short loan term

Indeed, a Mobile loan, as a rule, has higher interest rates than loans issued by a bank. This is associated with a higher risk of default on loans for financial institutions. After all, if the borrower ceases to pay, then it will take time and additional costs to recover the outstanding loan through the court. Therefore, financial companies lay these costs in the cost of the loan.

Another big inconvenience of a Mobile loan is a short term. Usually the maximum period does not exceed 3 months. Therefore, if you require more than 2 of your salaries (monthly income), the Mobile loan will not work. True, there are exceptions to this rule – if you take a Mobile loan a second or third time, then financial companies increase the size of the loan for you, as for a client with a good reputation.

How to choose the best loan?

A huge number of banks and Payday lenders offer their services in the lending market. To quickly compare all offers, you can use the Upfinance service, where you will find all existing credit organizations in the Philippines. The site provides complete information about loans: requirements for borrowers, interest rates and loan terms.

Using the filter by type of loan, you can easily and quickly choose the right offer that will suit your needs. If you are looking for a Mobile loan, you can additionally look at the offers for Online loan, because often banks call this type of loan that way. Historically, at the beginning they issued loans only from tank sites, and then improved the service and released a mobile application.

Thus, mobile credit can be considered one of the most affordable types of loans. And in the future we can only expect the development of this direction.

Leave a Reply